Trading hubs such as seaports play a vital role in connecting economies across the globe, with 80% of international trade carried by sea. The Port of Rotterdam is Europe’s largest seaport and has the strongest investment opportunities in Europe for port logistics. That is why the Rotterdam Harbour area is another key investment theme for Avignon Capital during 2021.

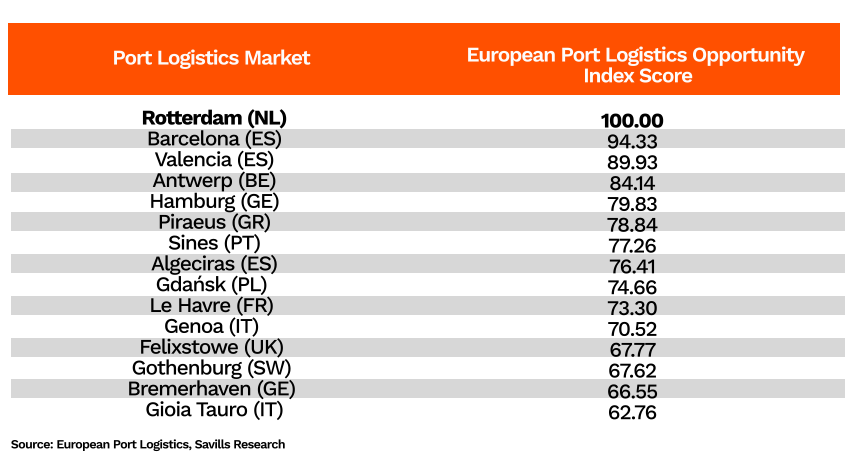

Widely recognised as one of Europe’s most important gateways, it recorded a freight throughput of almost 470 million tonnes in 2019 and created employment for some 385,000 people. A report by Savills in 2020 placed Rotterdam as the most attractive European port for logistics investment.

World-leading infrastructure, an increasing appeal amongst international businesses (despite a sharp fall in available office space in recent times) and a growing Rotterdam population ensure that the harbour and the surrounding area remain high on investor wish lists. That applies to office, industrial and residential investors as well as those from the logistics sector.

The harbour’s shortage of land supply makes it one of the most exciting investment prospects in Europe. With demand heavily outstripping supply in the region, there is vast potential for rental growth and yield compression, and that will be bolstered even further as a major development plan takes shape to accommodate the port’s ever-growing prestige.

Seaports across the world are in a state of constant evolution as they respond to new patterns and volumes of global trade and the case is no different with the Rotterdam port. It is currently in the middle of a vast regeneration masterplan, Port Vision 2030, which will see the region broaden its presence even further through public and private development – aiming to establish the port as Europe’s industrial cluster.

The masterplan firmly acknowledges the relationship between the port’s development and Rotterdam’s economic growth, which inevitably provides several exciting opportunities for investors across all asset classes seeking a stake in one of Europe’s most ambitious regeneration projects. It is one that aims to attract approximately €2 billion in private and public investments annually and create an additional 180,000 jobs.

The port’s investment appeal is not grounded exclusively in long term considerations. The arrival of the global pandemic in 2020 meant that Rotterdam Harbour faced one of it’s most challenging years in recent times. Years of strong growth was halted as the global economy came to a standstill – throughput in the first three quarters of the year fell by 8.8%.

A reduction in international trade brings with it a number of attractive investment opportunities in the form of price adjustments. Avignon Capital will be targeting strategic locations in and around the harbour as one of our key investment themes for 2021. Under-managed industrial and office assets will form our core area of focus, building upon our existing portfolio in the region.

If you would like to hear more about our plans for the Rotterdam Harbour, our existing portfolio or anything else, please get in touch. touch.