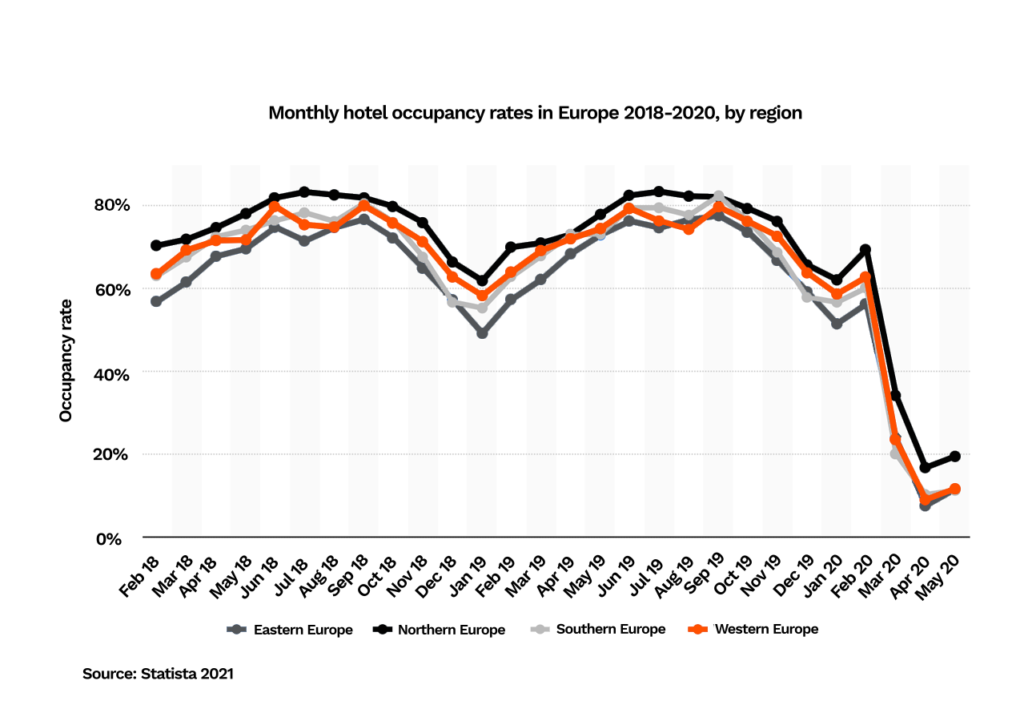

Another of Avignon Capital’s key investment themes for 2021 is value-add hotels. The hotel sector has been the most profoundly hit owing to the socio-economic implications of the global pandemic, with occupancy rates and revenue per available room falling to all-time lows according to STR.

Industry experts predict a full recovery won’t take hold until 2023 or 2024 which could offer a compelling opportunity to transact within the sector in the meantime, with the aim of benefiting from this operational recovery in the medium to long term.

Low operating profits and reduced access to debt finance will place significant pressure on hotel operators across Europe, particularly those who have already suffered from poor management and lack of investment. It is a backdrop which presents a number of openings for investors to acquire assets at discounted prices.

This reduced demand period also provides fertile ground for hotel repositioning and refurbishment programmes, ensuring assets are in prime position to capitalise upon the inevitable uptick in occupancy rates once borders re-open and workforces are on the move again.

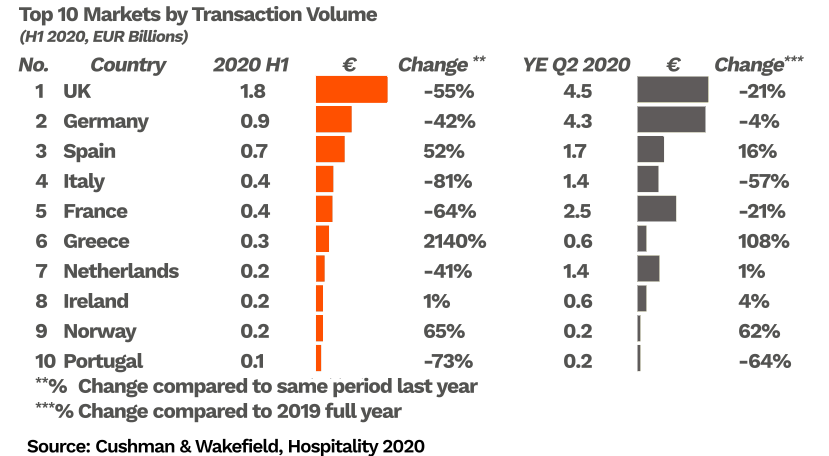

The European hotel market is widely recognised as one of the most attractive investment sectors in commercial real estate and experienced record-breaking investment volumes before the Covid-19 outbreak. Total European hotel investment climbed to €27.8bn in the 12 months to Q4 2019, representing a 13.9% year-on-year increase according to CBRE which followed another record-breaking year in 2018, in which volumes were 73.2% above the ten-year sector average.

Investors have continued to declare their confidence in the sector’s long-term prospects despite the pandemic’s economic fallout.

Several major hotel acquisitions were completed during the first peak of the Covid-19 pandemic and the table below features all five of Avignon’s core markets – UK, Germany, Spain, Netherlands and Portugal. And looking ahead, The Netherlands is Europe’s most attractive hotel investment destination according to Deloitte’s annual industry survey.

The hotel sector’s recovery will be deeply intertwined with the global economic recovery; an inevitable new-supply slowdown, increased volumes of distressed assets and sturdy underlying demand represent attractive long-term investment considerations.

In the more immediate sense, the gradual re-opening of offices will see domestic travel play an important role in short-term income prospects – domestic overnight stays accounted for 82% of total overnight stays in Germany in 2019. And UK Google search phrases for “staycation” increased by over 500% annually in July 2020, another exciting development in the travel industry which hotels are set to benefit from.

There is no getting away from the fact that the hotel market hasn’t got off lightly since the global pandemic erupted. However, with significant pricing shifts afoot and the lifting of travel restrictions inevitable, the hotel investment landscape looks promising.

If you would like to hear more about our existing hotel portfolio, our plans for the sector in 2021 or about our services, please get in touch.