ESG

Our ESG Objectives

It is our mission to be the leader in Real Estate in the implementation of ESG and ensure our knowledge on best practice is ahead of the curve. Investing more responsibly for our investors, as well as looking toward longevity, future trends and requirements that are being increasingly demanded across the real estate sector.

Our objectives

- 1Industry leading in the implementation of ESG practices

- 2Incorporating meaningful and effective ESG initiatives across both corporate and real estate

- 3Accelerating Sustainable and impact transformation with set targets through to 2025

- 4Adjusted strategies for each real estate sector to ensure effective roll out of ESG initiatives and maximise impact

- 5Enhanced reporting and benchmarking to cover both initial and on-going management initiatives

- 6Continuous research and regular evaluation to be ahead of the curve with implementing ESG initiatives

- 7Ensuring all employees are well versed in ESG principles and promoting diversity, inclusion and equality across the hierarchy of the organisation

Corporate Standards

We believe that ESG factors are integral to assessing the quality of our company and the assets we manage.

We aim to always act with integrity and ensure we are not ‘greenwashing’ the standard of our work. We are an equal opportunities employer, and we ensure to promote diversity and inclusion across the hierarchy of our organisation.

-

Mental Health: Access to EAP and on site Mental Health First Aiders

-

Health Insurance, Discounted Gyms, Cycle to Work Scheme

-

Flexible Working Policy

-

Focused on fair and diverse recruitment process

-

Enhanced reporting and benchmarking to cover both initial and on-going management initiatives

-

Inclusive staff Culture & Events. Company Incentive Trips Abroad

-

Charity: Fundraising , and Company Volunteering Days

-

Staff Training in Environmental Friendly Behaviour

-

Sustainable Marketing Collateral

-

Reducing Single use Plastic

-

Catering by Environmentally Proactive Companies & Organic Fruit in Offices

-

Offsetting Carbon Footprint by Planting Trees

-

Green Offices: Renewable Energy, Recycling Initiatives, Purified Air & Sustainable Resources

OUR GOVERNANCE

-

STRONG GLOBAL BUSINESS CONTINUITY & DISASTER RECOVERY PLANS

-

CODE OF BUSINESS CONDUCT

-

AUDIT: IFRS STANDARD, FS102 & LOCAL GAAP

-

GDPR CONSULTANT, ANNUAL STAFF TRAINING & QUARTERLY AUDIT

-

ANTI MONEY LAUNDERING COMMITTEE & REGULAR STAFF TRAINING

-

IT SECURITY: CYBER ESSENTIALS CERTIFIED & ANNUAL CYBER SECURITY TRAINING

Our Steps To Responsible Investing

Deal Sourcing

Targeted European markets through established network to implement ESG strategies. Detailed initial ESG assessment criteria and costings forming part of business plan underwrite.

Investment Decision

ESG benchmark certification targets, risk analysis on both Environmental and Social initiatives, ESG linked loans profile, financial performance without ESG compromise.

Proactive Management

Continuous local based management process to unlock and enhance each ’Impact layer’ including: ongoing certification and energy audits, community and tenant integration, Green lease monitoring, estate ESG taskforce establishment. Closed-loop sustainability (asset managers, property managers, tenants and service providers).

Sale

Sustainability ‘passport’ delivered. At completion of the business plan – provide the market with a clear sustainability ‘passport’ to establish clear credentials of ESG performance and initiatives carried out. Clear ongoing management manuals to ensure that performance can be maintained to the next generation of owners

Sectors

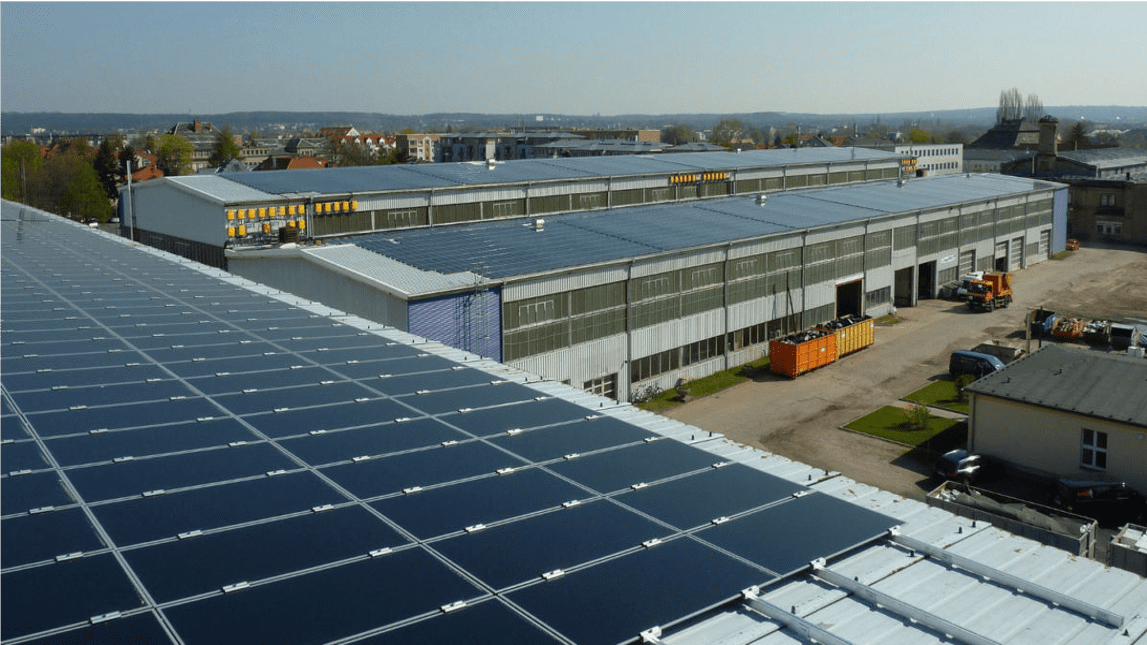

Industrial

- Green lease clauses to determine power and water usage

- Solar options

- Waste disposal / recycling

- Landscaping and green space

- Water storage systems / rain water harvesting

- Heating systems – air source heat pumps

- Energy efficient comfort cooling

- E-charging stations for cars and bikes

Hotels

- Tenant sustainability commitment through management arrangements

- Recycling initiatives

- Understand operators ESG goals and work together to implement plans

- Green space / planting and community engagement measures

- Renewable energies

- Energy monitoring systems

Retail

- Sustainably conscious tenants

- Recycling initiatives

- SKA – Sustainable fit out programmes and construction/ fit out recycling of building materials

- Landscaping and green space

- Water storage systems / rain water harvesting

- Energy efficient comfort cooling & air purifying

Offices

- Sensitively upgrade building to minimise construction impact

- Effective ESG property management processes

- Tenant ESG engagement and green leases

- Energy monitoring system

- Alternative M&E systems

- Renewal energies

- Green space / planting and community measures

- Recycling systems