Our fourth and final investment theme for 2021 is Lisbon, focusing on its thriving office market. Portugal experienced a severe economic slump in the aftermath of the global crash and its government responded by introducing a series of financial incentives to encourage economic growth. The result has been one of overwhelming success, with Lisbon playing an instrumental role in its impressive recovery.

Cultural, lifestyle and infrastructure offerings have attracted tourists and businesses worldwide, and the city has subsequently emerged as an elite investment location.

Like all other major European cities, Lisbon has suffered from the global pandemic. Portugal’s economy contracted by 7.6% in 2020 and Lisbon’s office market felt the weight of that – occupation rates fell 29% annually and transaction volumes were at their lowest since 2001.

The short-term outlook is expected to be one of limited growth as Lisbon grapples with the global pandemic’s ongoing influence. The medium to long term outlook, however, is far brighter. The city’s office market benefits from a robust set of investment fundamentals that lay the foundations for a rapid recovery and future growth.

Lisbon’s office market is characterised by low supply levels and deep occupier demand. Its growing reputation is seeing international organisations migrate in high numbers – CBRE reports that the volume of occupied office space taken up by international firms increased to 71% in 2020. Relocation was the main driver for office activity in 2020 and accounted for 62% of take up.

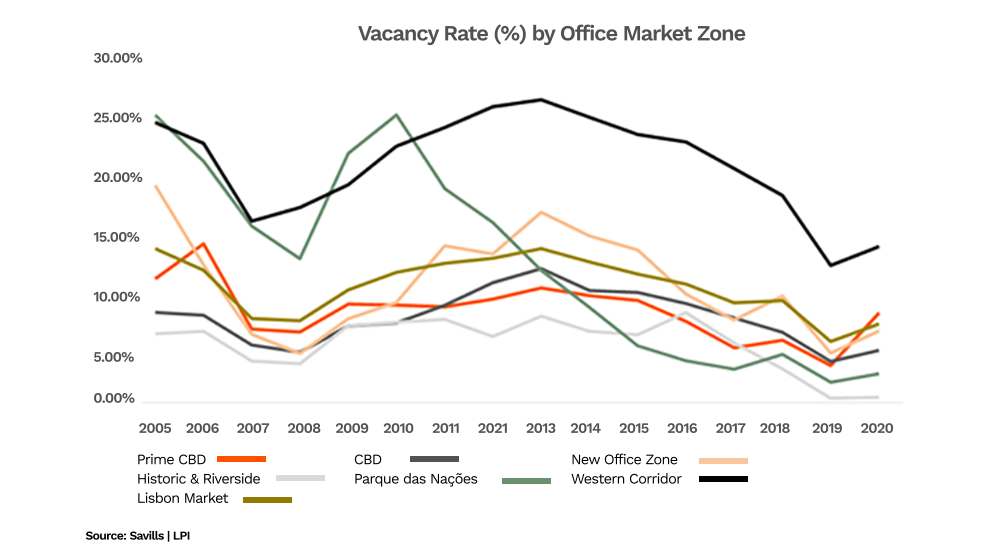

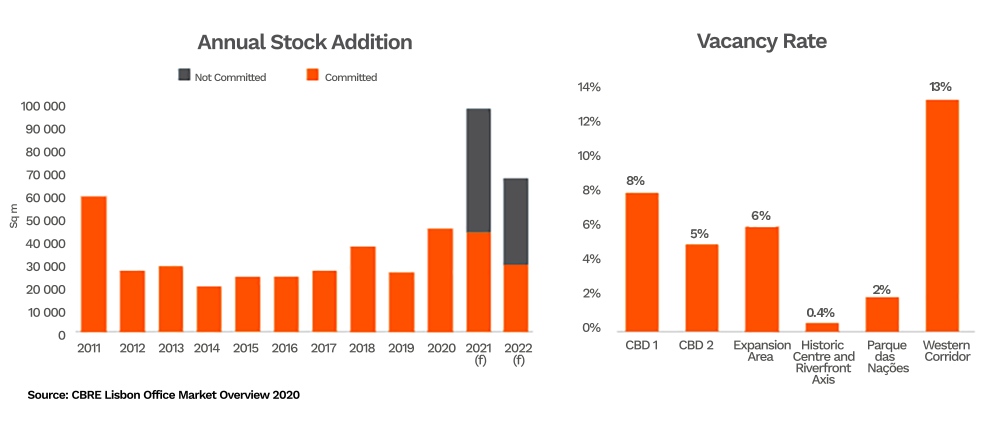

Despite growing supply levels, 2020 saw Lisbon witness its greatest annual increase in new office space in the last nine years – demand is still not being met. Vacancy rates crept up very slightly in 2020 but remained at historic lows of around 6.8%. The city’s Central Business District posted between 4% and 5% and its historic riverside zone as low as 0.4%

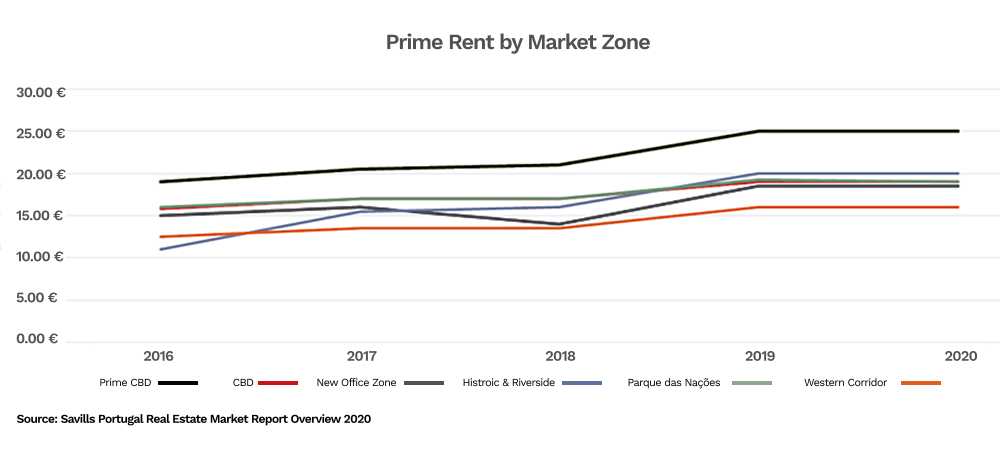

A limited stock supply and increasing demand is set to keep rental values stable for the time being – prime values are currently at €25 per sqm and represent some of the lowest of Europe’s commercial destinations.

Low rental values have served as a significant pull factor for businesses relocating to or expanding into Lisbon and also allow for future income growth as the city continues on its upward trajectory.

Lisbon’s supply shortage is largely a matter of quality, with a large portion of its stock no longer suitable for accommodating the modern-day workforce’s needs. Such a scenario offers two key benefits to investors: it paves the way for increased supply of high quality, contemporary offices that will positively impact rental levels’ performance in their respective locations. It also means Lisbon offers a comprehensive scope of value-add opportunities and particularly those which are grounded in refurbishment and repositioning programmes.

The overarching narrative is clear: Lisbon’s low supply, high demand and unwavering growth potential will continue to drive the city’s attractive investment environment. The ongoing influx of international corporations accompanied by strong development pipelines in the residential, hotel and retail sectors will ensure that Lisbon’s pre-pandemic journey of unfettered growth is re-ignited once the world returns to normal.

In the meantime, investors will be wise to capitalise upon the wide variety of investment opportunities at their disposal now.

If you would like to hear more about Avignon Capital’s Lisbon portfolio and our plans for 2021, please get in touch.