Extended relief packages announced at last week’s Budget will come as welcome news to a hotel sector which has had little to cheer about since the pandemic began. But whether these support measures and those being rolled out over Europe, will be enough to radically improve the outlook for the hotel sector is less certain.

The current set up, in which hotels are becoming increasingly reliant upon governmental support to stay afloat, is unsustainable. Whilst the furlough scheme and European variants of it will keep cashflows steady for the time being, the upsurge in distressed assets coming to market is unavoidable – it’s a question of when not if.

STR’s 2020 figures for Europe reveal the extent of the hotel sector’s demise: Occupancy rates were down by 54% annually, whilst average daily rates and revenue per available room fell by 18% and 62% respectively.

The widely anticipated investor gold rush is yet to unfold, Savills reports that global transactions were down by 42% in 2020 and the consensus amongst industry experts is that investors have been biding their time up until this point.

JLL predicts that global transaction levels will recover by as much as 40% in 2021, and there is growing evidence to suggest that momentum is building as the combination of an easing debt market, bottom line pressure and looming forbearance deadlines leave many hotel operators with no choice.

Avignon Capital is already working with investors who are ready to deploy capital once the distressed opportunities materialise.

“Our view is that the window of opportunity will become most prevalent in mid to late 2021 and continue for anything between 12 and 24 months.”

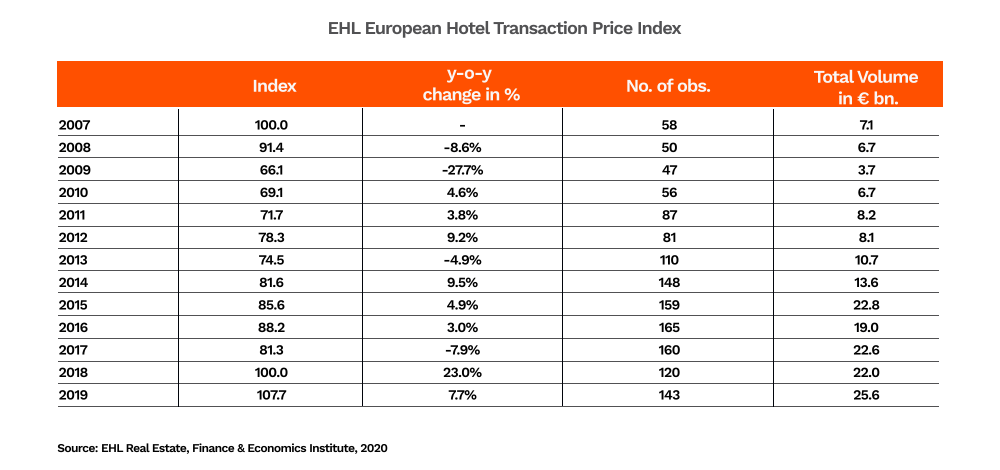

Historic economic downturns provide useful insights in this regard. Savills looked into hotel performance after 9/11 and found that it took 31 months for transaction levels to recover. It also revealed that transaction volume recovered more quickly than trading performance despite being hit more severely in the short term. When it comes to the Global Financial Crisis, the EHL Institute of Real Estate Finance and Economics reports that European Hotel Transaction volume fell by almost 50% between 2007 and 2009 but returned to pre-crisis levels during 2010.

Whilst it is too early to comprehensively define the legacy of the Coronavirus pandemic, there are some key trends that look set to emerge in response to the distressed surge.

1. Operational Difficulties

Both small and large operators will be feeling the burden of operational difficulties and we are already seeing the latter increasingly turn to sale and leaseback strategies in response.

2. Corporate Travel

We expect distressed opportunities to be most pronounced in markets dependent on international travel and corporate stays, given that corporate travel volumes are likely to recover at a modest pace. Hotels located in prominent business locations will take longer to rebound and offer a number of unique opportunities in the meantime.

Those assets will also be in a prime position to benefit from refurbishment/repositioning programmes as a result, which Avignon Capital has identified as a core area of focus for the year ahead.

3. Domestic Travel

Conversely, domestic leisure travel and local business travel will fuel a faster recovery in the select-service and staycation space from both a demand and supply perspective. Investors will need to be aware that significant price adjustments are unlikely to take hold here and seasonal income flows might present a further challenge.

Looking forward to 2023/2024, investors could be in for an exciting post-pandemic recovery period if pre-pandemic performance is anything to go by. The years in the run-up to the pandemic saw the hotel market climb to unprecedented heights, with 2019 European investment volumes increasing annually by 13.9% to €27.8bn

In the meantime, investors with an appreciation of the underlying market fundamentals will see the next 12 to 24 months as a golden opportunity.

If you would like to hear more about Avignon Capital’s Hotel plans for 2021, please get in touch.