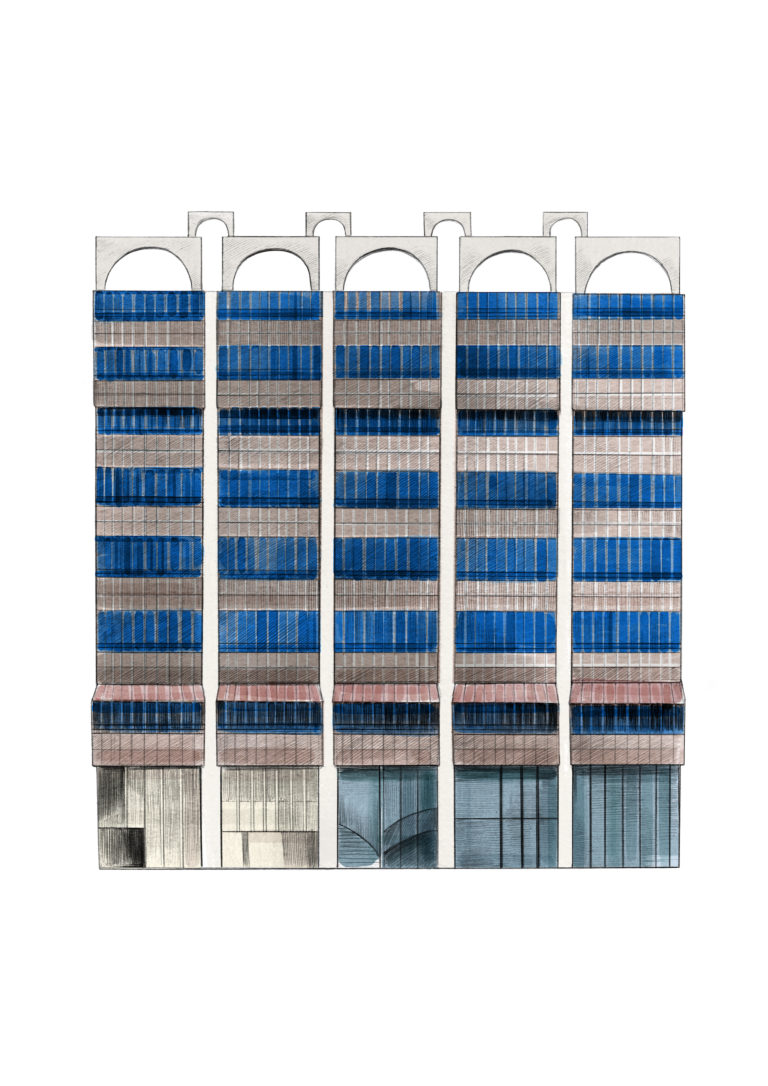

Miguel Bombarda, Lisbon

Lisbon

Tenant

Savills

Sector

Office

Address

Avenida Miguel Bombarda 4, Lisbon,, Portugal

Acquisition Date

Q1 2020

Our clients are a mix of family offices and institutional investors who want the best of both worlds – the benefits of a large real estate manager together with the flexibility and controls of a boutique manager.

We invest in high-quality assets and produce tailored investment exposures for our clients. Whether it be institutional funds or private clients our approach remains the same, ensuring they receive our complete dedication, energy and passion. Through regular communication we continue to review our clients investment exposure and how real estate fits within their overall investment portfolio.

High income and capital growth has been consistently delivered by identifying and managing investments which deliver value in all cycles of the property market.

Tenant

Savills

Sector

Office

Address

Avenida Miguel Bombarda 4, Lisbon,, Portugal

Acquisition Date

Q1 2020

Tenant

Staybridge Suites

Sector

Hotel

Address

Lange Vijverberg 16,, The Hague, Netherlands

Acquisition Date

Q1 2019

The newly converted 101 room apart-hotel marks Staybridge Suites’, which forms part of the Intercontinental Hotel Group, first opening in the Netherlands. This off-market acquisition is attractive…

Tenant

Various creative companies

Sector

Office

Address

Danzigerkade 161013 AP Amsterdam

Acquisition Date

Q4 2018

Danzigerkade 16 is a modern and sustainable building, which has been developed to a high ‘Grade A’ specification. The building is located in an up-and-coming ‘live-work’…

Tenant

Hyatt Hotel

Sector

Hotel

Address

Rijnlanderweg 800, 2132 NN Hoofddorp, Netherlands

Acquisition Date

Q2 2017

Avignon was given the opportunity to acquire another hotel in Amsterdam, which is excellently located in the main Amsterdam Metropolitan Area. The acquisition of the Hyatt…

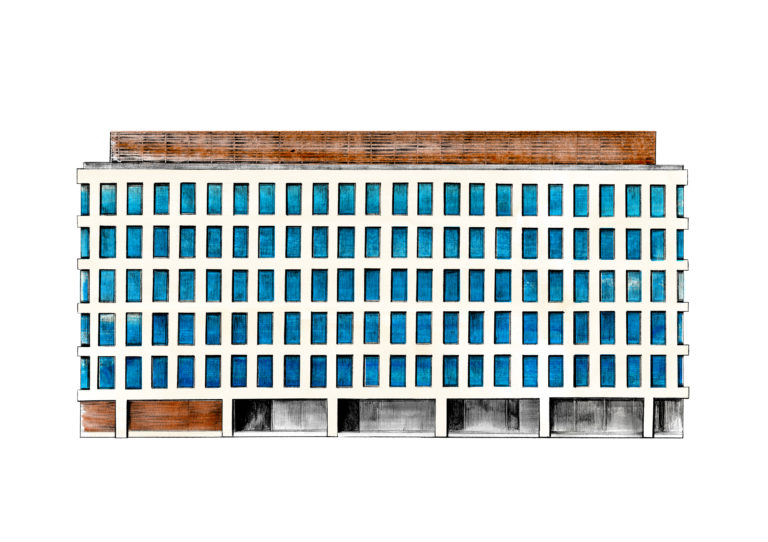

Tenant

The Organisation for the Prohibition of Chemical Weapons (OPCW)

Sector

Office

Address

Johan de Wittlaan 32, 2517 JR The Hague, Netherlands

Acquisition Date

Q2 2017

Avignon Capital acquired the purpose-built property, let to OPCW, for €38m. The deal to acquire the OPCW building presented Avignon with an off-market opportunity to acquire…

Tenant

Meininger

Sector

Hotel

Address

Bessie-Coleman-Straße 11, 60549, Frankfurt am Main, Germany

Acquisition Date

Q1 2017

Two hotels were acquired in Frankfurt and Berlin let to European hotel chain Meininger. The booming German hotel industry presented us with an opportunity to diversify…

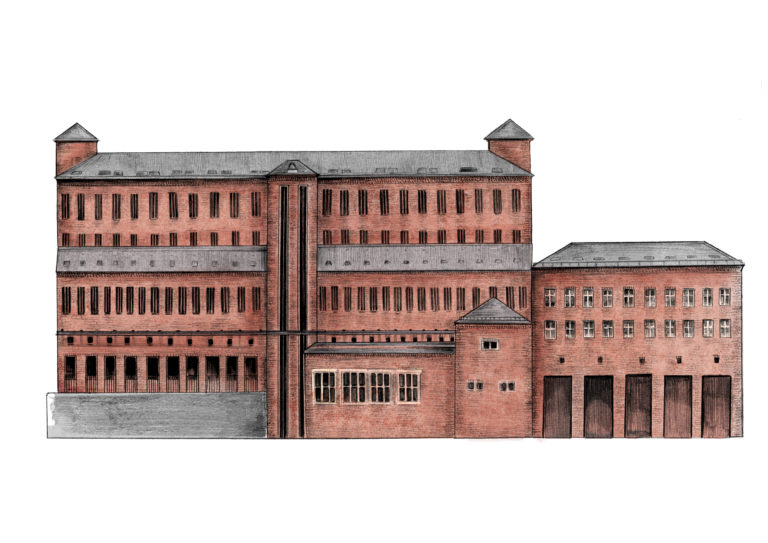

Tenant

GetYourGuide

Sector

Office

Address

Kopenhagener Str. 56, 10437, Berlin, Germany

Acquisition Date

Q3 2016

An opportunity was given to Avignon to acquire a second Umspannwerk, a tech focused mixed-use asset in Berlin’s tech cluster. We will maximize investment returns through…

Tenant

Multi-let to 13 tenants (incl. Tesco)

Sector

Retail

Address

4 Praed Street, London, United Kingdom

Acquisition Date

Q3 2004

Through active asset management which has provided strong rental evidence, we have driven sustained income growth at the last two rounds of reviews. We have recently…

Tenant

Prezzo, Boston Tea Party, Harborne Food School

Sector

Retail

Address

High Street, Harborne, Birmingham B17 9NJ, United Kingdom

Acquisition Date

Q4 2014

Architecturally attractive building in an affluent area of Birmingham. An off market acquisition delivering strong capital and income growth since purchase. We regularly hold food based…

Tenant

AllSaints, Bravissimo

Sector

Retail

Address

Pelham Street, Nottingham, NG1 2EH, United Kingdom

Acquisition Date

Q3 2015

An opportunistic acquisition of an architecturally outstanding high street retail block. With under 5 years on the existing leases the strategy is to improve the security…

Tenant

Banc de Sang I Teixits

Sector

Office

Address

Passatge del Taulat, Barcelona, Spain

Acquisition Date

Q1 2014

Acquired with the benefit of a 45 year unexpired index linked term to a tenant guaranteed by the Spanish government. The asset was refinanced in 2015…

Tenant

Multi-let to 20 tenants (incl. Red Bull)

Sector

Office

Address

Umspannwerk, Ohlauer Straße, Berlin, Germany

Acquisition Date

Q1 2015

TMT focused mixed use asset in Berlin’s start up hub. Berlin is an exciting market for us. Although the City is complex we believe the growth…

Avignon Capital gives clients the opportunity to invest in European real estate markets by developing individual investment strategies according to their risk/return parameters which Avignon fine-tunes to create the optimal risk-adjusted investment returns.

We understand the nuances between investors and a one-size approach doesn’t work, that is why we can provide access to different vehicles from single mandates on a deal by deal basis or constructing larger portfolios. Avignon is flexible in its approach and can where possible co-invest to demonstrate there is full alignment of interest.

We have deep knowledge and expertise in the UK, Germany, Netherlands and Iberia. This clarity of focus, along with our on the ground teams, deliver unique, personal insights and opportunities that would be missed by larger or more dispersed firms.

We have a track record of delivering above-average returns to our investors through strategic asset allocation and active asset management.

Our full-service offering delivers a streamlined service where clients communicate directly with their investment and asset managers and are supported by our on-the-ground network of experts and offices across our four countries.

We are client-centric – focused on serving our clients to the highest standards and by having a wider range of in-house services means we have more autonomy, flexibility and can react faster to client requests.