Our first insight piece of 2021 discussed our investment themes for the year ahead. A key focus for Avignon Capital will be the UK supermarket sector, an exciting subset which continues to play a largely anomalous role in a declining retail market and boasts an attractive long-term outlook.

2020 was a year in which supermarkets illustrated their growing appeal amongst investors seeking a stable alternative income source and the UK market is now worth £184bn.

The 2020 grocery review from Colliers revealed that more than £1.8bn of supermarket assets were traded in 2020, whilst December saw the highest volume of grocery sales in history.

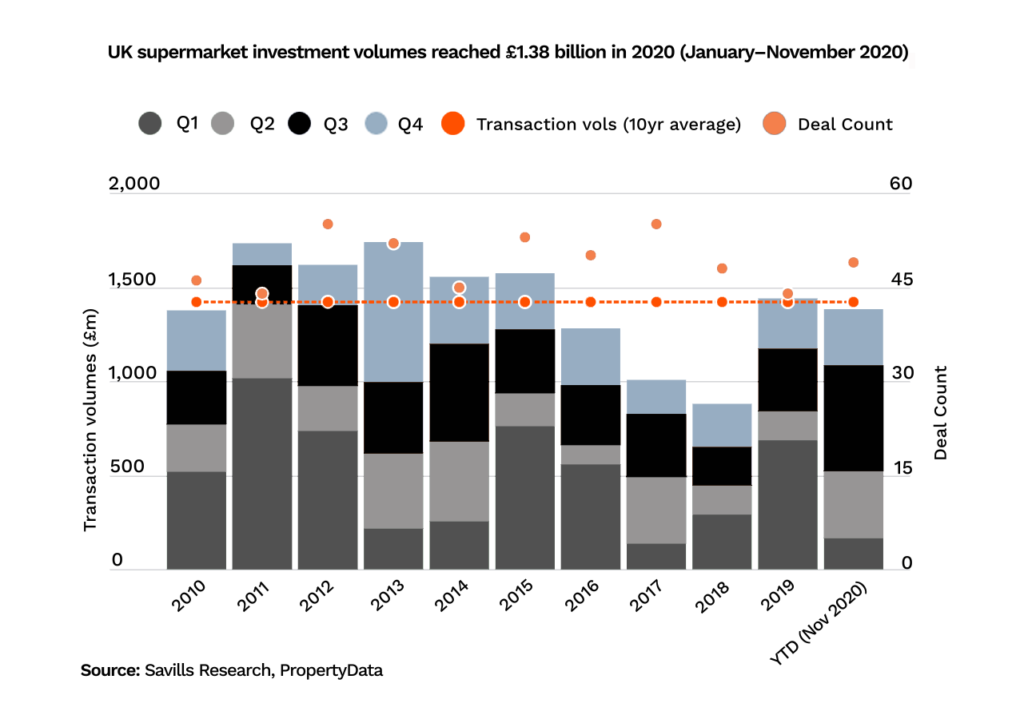

Similarly, Savills reported in November 2020 that UK deal count had already exceeded 2019 levels by 11.4%, whilst the UK’s largest supermarket landlord, Supermarket Income REIT, collected 100% of rental payments in Q2 and Q3. That came off the back of a hefty investment drive from the REIT which included the £102m acquisition of 26 Sainsbury’s stores from British Land and its first purchase of an Aldi store.

The ongoing economic conditions presented by the global pandemic have, in many ways, played into the hands of the sector as consumer reliance upon supermarkets has become particularly pronounced.

Grocery sales in the UK grew at their fastest rate in 26 years at the height of the UK’s first wave and in December 2020 £11.7bn of sales were recorded – whilst online shopping also hit a peak – accounting for 11.5% of all grocery sales. Again, online grocery shopping grew by 91% in the four weeks to June 14th, illustrating a strong correlation between pandemic conditions and supermarkets’ performance.

Investors have responded too – volumes between January and November 2020 reached £1.38bn and exceeded the five-year average by 11.7%.

That upward trend is here to stay.

From a structural perspective, the sector is underpinned by a robust set of investment fundamentals. Operational strength, stable rental income (typically responding in line with the Retail Price Index) and a growing and increasingly diverse base of established corporate occupiers are strengthening demand amongst investors.

Moreover, the relative decline of the wider retail market offers favourable investment conditions for supermarkets. Funds looking to reduce their retail exposure are forced to offload their only liquid retail assets (supermarkets), producing a scenario in which distressed vendors release non-distressed assets. It’s a trend that Avignon Capital and many industry experts predict will continue throughout 2021 and one we will capitalise upon.

Early indicators of confidence include Supermarket Income REIT’s £100m acquisition of three Waitrose, Tesco and Morrisons stores in late January and we anticipate many more transactions to be announced over the course of the year.

The pandemic-influenced economy, changing consumer habits and an increasingly competitive marketplace mean the sector is perfectly poised to capitalise upon the economic recovery of 2021.

The relative decline of retail has forced many funds to reduce their exposure to the sector, and with supermarkets often representing the only liquid assets within that, distressed vendors are increasingly offloading non-distressed assets.

Avignon Capital wrapped up 2020 with the purchase of a Waitrose portfolio in Glasgow at a discounted price, and we look forward to announcing further deals in due course, growing our exposure to an increasingly attractive sector.

If you would like to hear more about our plans for the supermarket sector, please get in touch via e-mail or phone.