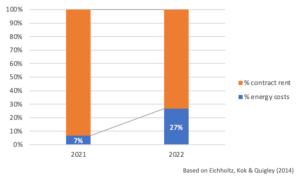

During the past decade, the real estate sector has witnessed an increased interest in energy efficiency, mostly to reduce carbon emissions. However, energy expenditures in offices, warehouses, shops, and other commercial buildings are often just a relatively small portion of total occupancy cost for a tenant. How small? That depends on the headline rent (and thus the location of the building), the type of building, and the intensity of use, but research shows that, on average, energy costs are about 7% of occupancy costs. That’s a simple, plain average for office buildings, and the percentage will be likely be lower in high-rent locations such as London City, Amsterdam’s Zuidas, or downtown Paris. But of course, energy costs relative to rent might be (much) higher for energy-intensive tenants in low-cost locations. Taking 7% as a starting point and applying the lower-end increase in energy prices, at 5x last year’s prices, that would lead energy costs to be more than a quarter of total occupancy costs. At that point, energy costs would certainly be material.

Reading this, most real estate investors would probably shrug their shoulders, because tenants ultimately bear the burden of heating, cooling and lighting the building. Whether that’s directly, when tenants buy energy themselves (in case of a net, double net or triple net lease), or indirectly (in case of a gross or full-service lease). In case of the latter, tenants would simply, through increased service charges, pay for the astronomical rise in energy prices. But, not so fast, this time its different – these increases will certainly affect investors in commercial real estate:

- Tenants have a fixed budget to locate their business and/or their employees, with the size of the firm affecting that budget. Higher service charge means a higher cost to rent office space, and higher energy bills imply the same for tenants that typically procure energy directly, such as retailers, tenants in multifamily/single-family housing, logistics and warehouse occupiers, etc., which means lower profits. Primark, for example, recently warned that profits will be dented due to energy expenditures increasing tenfold (!). As other costs increase for many firms due to record-level inflation, and as consumer demand saps with the emergence of a recession, tenants may start to reduce their floorspace, or even worse, may go out of business.

- The current bifurcation in the real estate market, particularly in the office market, will become even more pronounced due to higher energy costs for tenants. Post-COVID, we have already witnessed a divide between the “have’s” and “have nots” – those buildings at desirable locations or with desirable amenities versus the remainder of the stock. Assuming that the “haves” are also more energy-efficient buildings, tenants can get more bang for their buck by renting space in such efficient buildings. So, owners of buildings with low energy performance ratings (in Europe, buildings with EPC’s of F or G, for example) will face increased pressure to either reduce rents, increase capital expenditures, or do both, to remain somewhat competitive. That comes on top of government regulation in the UK and the Netherlands that already put pressure on inefficient buildings. The concept of a “green premium” or “brown discount” is becoming an economic reality, fast. And it’s not just offices: governments are increasingly looking to cap rents for inefficient homes and apartment, protecting tenants.

- Of course, the tenant doesn’t shoulder the energy bill in every building. Think about hotels, where the room rate is independent of the energy price, and where higher utility bills directly eat into margins. In that spirit, the publicly traded hotel owner PPHE “flagged that energy prices in particular are expected to form a headwind into 2023,” leading analysts at JP Morgan to reduce their price target for PPHE. What happens in the public market will also translate into the private market: hotel operators and investors, currently benefiting from a recovery in leisure and business travel, may see margin compression and slower-than-expected return to profitability.

These are just some of the asset-level implications of rapidly spiraling energy prices. As with every perfect storm, they come jointly with dark clouds on the macro-economic horizon. High inflation rates and continuing supply chain constraints affect consumer and business spending. While inflation may allow for large(r) rent increases, the question is whether all tenants can carry that burden, limiting the extent to which commercial real estate investors can increase rents. At the same time, historically large increases in central bank rates (including the ECB’s 75bps move), will increase the cost of capital, thereby reducing the value of commercial real estate. Of course, governments may intervene and subsidize businesses (as during the COVID-19 pandemic) or even cap energy prices outright (as planned the UK PM Liz Truss, see also this article). In the short term, that would help tenants and ultimately landlords. Those interventions will be costly though, paid mostly through increases in government debt, which ultimately needs to be paid back (think: higher taxes).

So, what can commercial real estate owners do? Firstly, reduce base building energy consumption through changing the temperature settings, which means slightly higher temperatures on the hot days that remain, and lower temperatures this Autumn and Winter. The onus is on tenants here too – so sit down and discuss how their energy bill can be reduced through behavioral changes. Secondly, spend capital on energy efficiency measures. That’s easier said than done, with typically longer lead times, but at current energy prices, payback periods on upgrading the HVAC system, improving building insulation, upgrading lighting (including smart sensoring) and other energy-saving investments are just a few years (if not less). Thirdly, deploy solar PV if and where possible, potentially in combination with battery storage. Many larger investors have deployed solar at scale, for years.

As the saying goes, “never waste a good crisis.” As bad as the current war and the subsequent economic/energy crisis is, let’s at least use it to reduce the energy demand from the real estate sector.

If you would like to speak to us about how we can assist with your current property investment, you can contact our team here.