Avignon Capital explains why European investors should be paying attention.

Extended stay accommodation combines the benefits of a hotel with the convenience of an apartment and it has long been a mature, mainstream asset class in the US, catering to business travellers looking for a ‘home from home’ experience. In Europe, however, it tends to be seen as a niche alternative within the more established and traditional hospitality offerings, such as hotels.

We envisage a shift in this trend across Europe, as the extended stay sector evolves into an established asset class in the years to come. With the growth in contractors, business travellers and an ever-expanding mobile workforce, extended stay looks increasingly attractive.

The fundamentals are there the for extended stay sector. In contrast to full-service hotels, which are subject to seasonal fluctuations, extended stay offers stable income and predictability, as apartments are occupied for longer periods with lower running costs associated with traditional hotels.

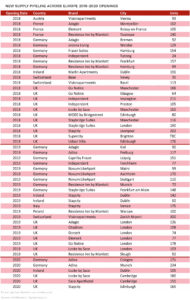

Big international hotel brands such as Hilton and Marriott have already tapped into the European extended stay market. Marriott’s Residence Inn concept which is well established in the US, expanded into Europe during 2017, an opening in London Bridge marked its debut of the extended stay brand into London, followed by further openings in Aberdeen and Amsterdam, with a further eight properties anticipated by the end of 2019 across Europe.

However, newer independent operators’ such as Roomzz and Zoku are evolving the extended stay concept further with targeted branding and marketing to appeal to their desired market. Zoku even goes further to offer communal social spaces.

Communal Space at Zoku

Favourable market conditions have begun to pique the interest of European developers and investors alike. While 25% of nights spent in European hotels are part of a stay of 5 nights or more, only 6% of existing hotel supply is classified as extended stay. [1] In 2015/16, business travel expenditure in North America totalled $296bn compared to Europe’s $397bn; however, there are 484,594 extended stay units in North America compared to just 114,012 in Europe.

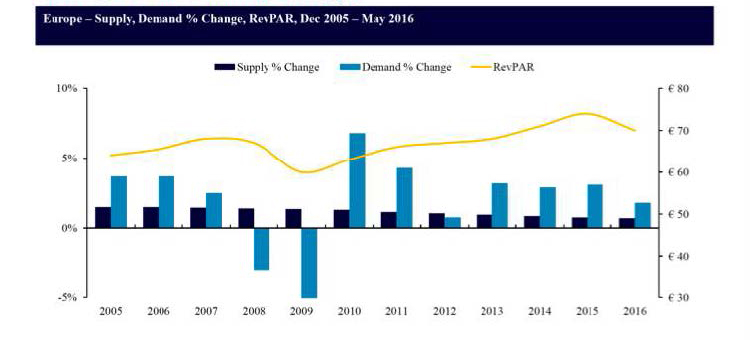

Extended stay yields offer attractive returns due to the high-profit margins derived from low operational costs. The sector is forecast to witness positive growth as the growing demand for extended stay continues to outpace supply growth, as shown in the graph below. [2]

Investors are beginning to take note and are now aware there is a demand for alternative forms of accommodation to traditional hotel rooms. In the UK an extra 2,000 serviced apartment units are set to open in 2018 [3] a 9% increase on current stock. As extended stay begins to emerge in European cities such as Amsterdam, Paris and Berlin, we believe the buyer pool for the sector will grow at a faster pace than established core sectors.

Avignon Capital has multiple hotels in its portfolio, including the Hyatt Place in Amsterdam and Meininger Hotel in Frankfurt, nevertheless we are an investor taking note and we will look to diversify into the serviced or extended stay accommodation sector as we recognise the potential from the sector.

[1] Source: Serviced Apartment Summit Europe

[2] Source: STR

[3] Source: Serviced Apartment news