Why outsource your real estate accounting?

In today’s uncertain market, companies may be looking for ways to grow their business or protect it and outsourcing your accounting services can be a way to achieve this.

There are many advantages of outsourcing and in this article, we look at why fund managers and real estate owners should consider outsourcing and how to choose a real estate accountant.

When should you consider outsourcing?

Time to focus

The crucial time to outsource is when your existing employees are being slowed down with accounting tasks which are taking them away from your core business. Companies should be focusing on strategic activities such as shareholder relationships and forecasting, rather than repetitive and time-consuming accounting tasks.

Flexibility and Costs

The COVID-19 crisis will have an impact on companies, who will have to take actions to cut operating costs. To combat economic uncertainty, you need the flexibility to expand or downsize quickly. You may be experiencing high volumes of growth, but do not want to take the risk of expanding your finance team and incurring costs of the recruitment process. During your reporting period, you can get access to a whole team of accountants without having to take on the staff for the rest of the year.

Expertise

Even prior to COVID-19 investors were demanding more reporting. The complexity of compliance is increasing and if your employees have limited real estate accounting knowledge, you run the risk of errors being made. However, if you outsource to a specialist who is 100% real estate focused you mitigate the risk of any errors as they are best placed to manage the process and can meet compliance requirements.

What to outsource?

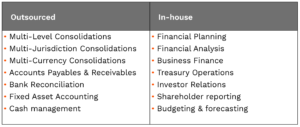

Finance and accounting processes can be broken down to different functions and whilst some can be kept in-house there are key functions which are performed better when outsourced to a specialist.

The table below is a recommendation of which processes to keep in-house and which should be outsourced.

Group Consolidations and Group Financials

Group consolidations are a key function that you should consider outsourcing. It is a complex process that requires both real estate knowledge and technical accounting expertise.

As well as the time and accuracy factors involved in consolidating multiple company accounts and data into a single set of financials, there are additional nuances often present in the real estate sector which should be handled by experts.

For instance, a real estate accountant would prepare accounts for a German property under local German GAAP using methods such as property depreciation, to meet local compliance requirements and tax returns. In parallel, they would also adjust these accounts under IFRS principles which instead use the property fair value method. Having all the data formatted under the same accounting standard (IFRS) is key to enabling a multi-jurisdiction group consolidation to be performed. This is considered a non “value-adding” activity to many real estate funds and managers, however, without this, they would be unable to present the group financials and portfolio to the market or meet compliance requirements.

What should you look for when choosing an accountant?

Real Estate Specialist

Do not go generic, look for a specialist who only works in the real estate sector. A specialist will understand the nuances of real estate accounting compared to other sectors and can report on data that makes sense in a real estate context. They will understand how an investor wants to see a set of real estate accounts compared to other businesses

Fee transparency

Fee transparency is paramount. If the reason to outsource is to save costs, then the accountant should provide a clear service level agreement, so you understand what you get for your money. Having very clearly defined expectations in the initial agreement will mean they are accountable and there are no unexpected invoices, only the work that is required as per the agreement is charged for.

Technology

Check what technology they are using. To produce high quality and accurate reports they should not be completing manual consolidation entries in Excel, they need to be using technology that can achieve this from a real estate perspective.

Real Estate accountants use specialist real estate software such as Yardi Voyager, which gives them a competitive advantage over standard accountants. The Yardi Voyager platform has the functionality to do everything in one system from the property level (including service charge reconciliations) up to the SPV level, and then can be consolidated into any currency/country no matter how complex it is.

Track Record

Request to see their track record. If you want a specialist real estate accountant, then ask to see examples of their work.

As an example, if you are a UK REIT or considering becoming one, then it is good to work with a company who has experience producing listed standard financials and working to strict reporting deadlines.

________________________________________________________________________________________________________________________________

In short, if you want to focus on strategy and growth or simply just looking to cut costs, then outsourcing your real estate accounting could be the key to unlocking value across your business.

Avignon Capital is an outsourced solution for many companies and is 100% real estate focused. We can help you tick boxes from a compliance point of view, but also assess the performance of your portfolio.

For more details on how Avignon Capital can help you, contact us using the contact form below and our Head of Corporate Accounting will be in contact to discuss your requirements.